Qualcomm's just-announced second-quarter revenue and profit expectations fell short of Wall Street's expectations, causing its stock to turn from gains to losses in after-hours trading. Qualcomm said it was grappling with the twin effects of weak demand for smartphones and an oversupply.

"Discussions with mobile service providers point to persistent and deepening weakness in global smartphone demand, which does not bode well for Qualcomm," said Maribel Lopez, technology analyst at Lopez Research. "

However, even though inflation and macroeconomic uncertainty have reduced demand for consumer electronics, Qualcomm's performance has not suffered much as it focuses on the higher-margin market of high-end smartphones. The company is also said to be diversifying into emerging and fast-growing new categories such as automobiles.

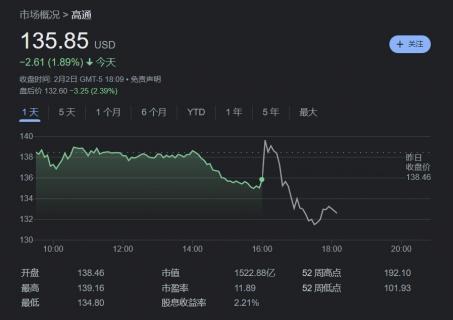

The company's fiscal first-quarter revenue fell 12% from a year earlier to $9.46 billion, missing Wall Street's forecast of $9.6 billion. IT Home found that the mobile phone business, which accounts for the largest share of Qualcomm's total sales, had revenue of only US$5.75 billion in the first quarter, a year-on-year decrease of 18%, while it increased by 40% in the previous quarter.

Worldwide smartphone shipments fell 18.3% in the quarter ended Dec. 31, the biggest quarterly drop ever, according to IDC.

Smartphone chip companies, including Apple supplier Qorvo, forecast weak earnings prospects as their customers continue to clear inventory. Analysts at Cowan expect smartphone shipments to fall 4% this year, as it will take time for Chinese demand to recover after the outbreak of the new crown epidemic.

Qualcomm expects adjusted earnings per share of $2.05 to $2.25, compared with analysts' forecast of $2.26.

Qualcomm Incorporated Earnings at a Glance (GAAP):

- Earnings (Q1): $2.24 billion. That compares with $3.4 billion last year.

-Revenue (Q1): $9.46 billion, compared to $10.71 billion last year.

- EPS (Q1): $1.98 compared to $2.98 last year. Analyst Estimate: $2.34

- Next quarter EPS guidance: $2.05-$2.25; revenue guidance: $870-$9.5 billion.