With the increasing demand for high-end chips and the shortage of Nvidia graphics cards, many Chinese customers have started to seek alternative options. One example is the DCU Z100L, a domestically produced graphics card manufactured by Haiguang. According to Wang Fei, some of his clients who were working on AIGC projects have opted for this alternative.

The scarcity of Nvidia graphics cards has also led to inflated prices in the market. Some individuals who bought A100 80GB cards prior to the implementation of the chip export restriction policy have dismantled and resold them for higher prices. These older cards, however, do not come with warranties and are more expensive compared to last year's prices. Additionally, the supply of graphics cards remains limited, and buyers must have cash in hand to secure a purchase. Even new A100 40GB cards, which have smaller memory capacities and lower training efficiency, are not attracting much demand.

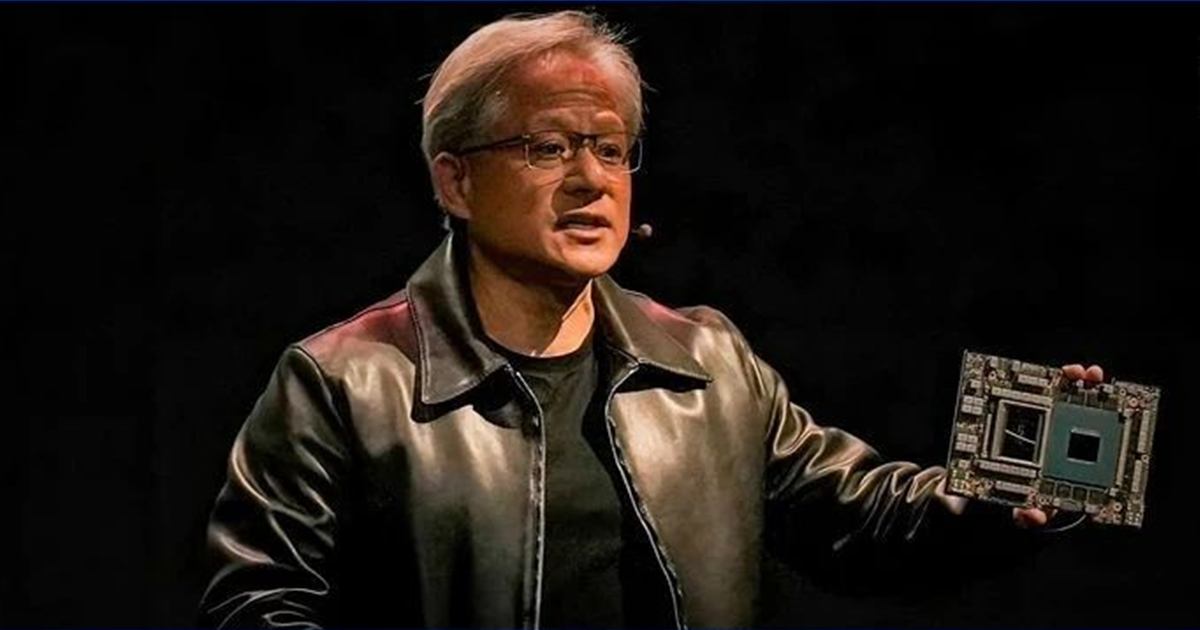

The surge in demand for Nvidia products has been remarkable, with the company receiving an overwhelming number of orders. Nvidia's founder, president, and CEO, Jensen Huang, acknowledged this surge during a recent earnings call. He described the new product demand since January as "incredibly steep" and expressed the company's disbelief at the high volume of orders. Alongside the market's frenzy for Nvidia products, the company has also witnessed generous support from investors. In fact, Nvidia became the first chip design company to reach a market value of over $1 trillion on May 30th.

Furthermore, the competition for acquiring Nvidia high-end graphics cards has turned into a race, as they have become an essential component for AI startups. One factor that determines the success of these companies is their ability to obtain at least 100 Nvidia graphics cards. However, since August of last year, domestic A100 supply has been cut off, and even importing from overseas is challenging due to strict customs regulations. This scarcity has made it nearly impossible for AI startups, especially small and medium-sized ones, to access A800 and H800 chips specially supplied to China.

Amidst this frenzy for AI chips, acquiring a sufficient number of Nvidia high-end graphics cards has become an expensive and challenging endeavor. Some companies are reported to be offering Nvidia graphics cards for sale at exorbitant prices, with figures reaching over 100,000 RMB per card. This scarcity has created a barrier for entry, making it increasingly difficult for AI startups to embark on their journey.

As Nvidia continues to thrive in the chip industry, it is worth noting that China is also making efforts to catch up in the GPU market. Huang Renxun, Nvidia's founder, highlighted the company's early recognition of the transformative power of AI and its commitment to revolutionize the industry through comprehensive changes at all levels. Starting in 2016, Nvidia's Tesla product line, specifically designed for AI training tasks, aimed to enhance computational efficiency with the introduction of the P100 chip. Additionally, Nvidia developed the high-speed interconnect technology, NVLink, allowing for faster communication between CPU and GPU chips and further improving computational performance.

In the midst of this chip trade and booming demand for AI chips, AMPLE CHIP is actively involved in the chip trading business. However, the provided context does not provide specific information about AMPLE CHIP or its role in the industry. Therefore, additional information is required to further discuss the company's involvement in the chip trade.

In conclusion, the demand for high-end Nvidia graphics cards has surged, and the shortage of supply has led to inflated prices and alternative options. While Nvidia enjoys tremendous success and support from investors, AI startups face challenges in acquiring a sufficient number of high-end graphics cards. China is also striving to catch up in the GPU market. However, the involvement of AMPLE CHIP in the chip trade cannot be fully addressed without more information.