The chip manufacturing industry is witnessing an intense competition as companies race towards the development and production of smaller, more efficient chips. With advancements like the emergence of 2nm technology and the prospect of 3nm on the horizon, major players such as Taiwan Semiconductor Manufacturing Company (TSMC), Intel, and Samsung are vying for supremacy in this cutting-edge field.

TSMC and the 2nm War:

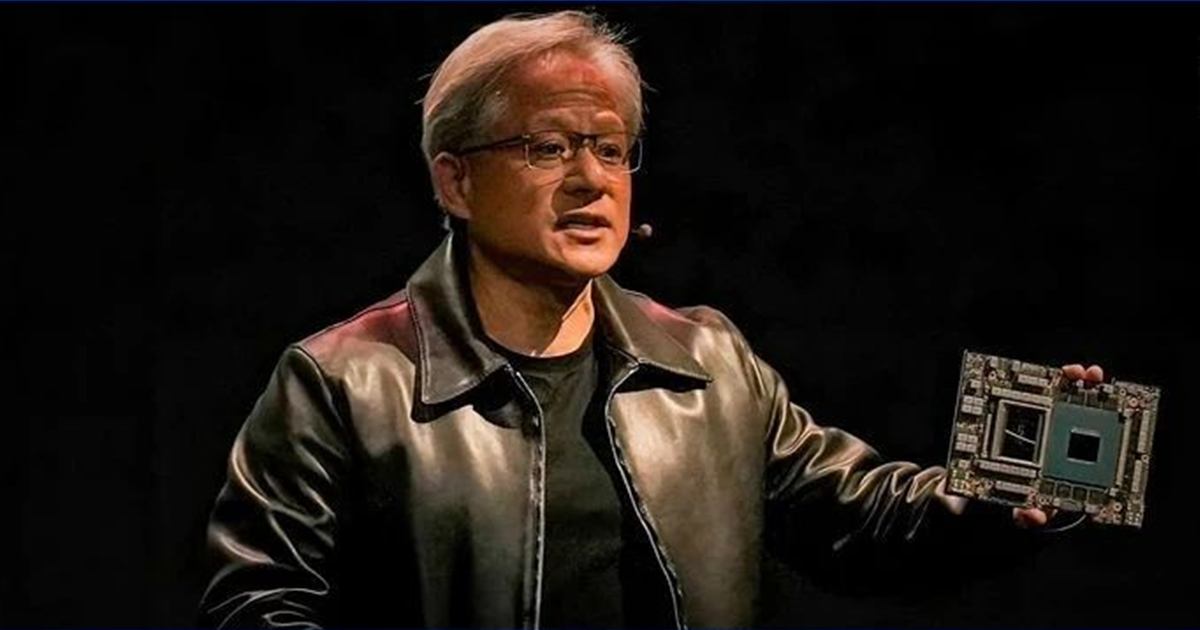

Recent reports suggest that TSMC has begun pre-production of chips utilizing the 2nm process, with giants like Nvidia and Apple potentially becoming their first clients [1]. This move could put immense pressure on competitors like Samsung. TSMC remains tight-lipped about specific details, but they have expressed confidence in the smooth progress of their 2nm technology development and aim to achieve mass production by 2025. The race for 2nm supremacy is truly underway, capturing the attention of the entire industry.

Intel's Technological Advancements:

Intel, a major player in the chip manufacturing arena, has showcased their progress in the development of advanced manufacturing processes. The company has completed the development of Intel 18A (1.8nm) and Intel 20A (2nm) manufacturing technologies [2]. While Intel gears up to remain competitive, it's worth noting that Rapidus, a recently established Japanese company, also has plans to achieve mass production of 2nm chips by 2025 [2]. This intensifies anticipation for a heated war in 2025 for chip dominance.

LX Semicon's Collaboration with Samsung:

LX Semicon, an affiliate of the LG Group-owned LX Group, has chosen Samsung as its manufacturing partner, signaling an essential collaboration in the development and production of next-generation chips [2]. LX Semicon intends to outsource the production of the next-gen display driver integrated circuits, showcasing Samsung's prowess in semiconductor fabrication.

Increasing Demand and Order Adjustments:

In response to the growing demand in the field of artificial intelligence (AI), major companies like Nvidia, Broadcom, and AMD have been ramping up their orders with TSMC for 5nm and 7nm families of chips [3]. Additionally, these companies are also vying for TSMC's CoWoS (Chip on Wafer on Substrate) production capacity, with the trend expected to continue until 2024. Overall, there has been an over 20% increase in order size compared to 2023 [3]. This surge in demand further emphasizes the significance of chip development and manufacturing.

AMD's Advancements in Chip Performance:

Recent tests conducted by MosaicML, an AI startup, compared the performance of AMD's MI250 chip and Nvidia's A100 chip. The results indicated that AMD's chip performance is comparable to 80% of Nvidia's A100 chip performance, owing to AMD's software updates and the release of the PyTorch open-source software [4]. The continuous software updates indicate AMD's commitment to improving chip performance, potentially closing the performance gap with Nvidia. MosaicML's Chief Technology Officer emphasized the importance of software development for most chip companies as their critical weak point [4].

The chip manufacturing landscape is witnessing fierce competition, driven by advancements in nanometer technology, collaborations between companies, and increasing demands in AI applications. The battle for chip supremacy is truly on, with TSMC, Intel, and Samsung leading the charge. Meanwhile, LX Semicon's partnership with Samsung and the pursuit of chip performance enhancements by AMD further illustrate the industry's dedication to pushing technological boundaries.

As the industry continues to evolve and competition heats up, it is fascinating to envision a future where chips become even smaller, faster, and more efficient, paving the way for technological advancements in various sectors. In this exciting era of innovation, AMPLE CHIP, a company actively engaged in chip trading activities, could find lucrative opportunities in the dynamic chip market. By leveraging the latest developments and embracing the potential of emerging technologies, AMPLE CHIP can play a pivotal role in facilitating chip trade and contributing to the growth of the industry.