Chips made by Huawei HiSilicon are displayed at the Huawei China Economic Partners Conference in Fuzhou, Fujian province, March 21, 2019.

Marvell Technology, a major Silicon Valley chip maker, confirmed on October 27 that it would lay off the company's R&D team in China and other personnel, causing shock in the industry. Observers said that the continued fermenting and expanding effect of the Biden administration's sanctions on China's chips will intensify the short version of China's chip talents, and since the US-China chip war started, China has been beaten all the way, and there is absolutely no weight to fight back.

Marvell Technology (also known as Marvell Electronics) is the world's largest supplier of hard disks. In the second quarter of this year, its revenue has just achieved nine consecutive quarters of growth, reaching US$1.517 billion, and its gross profit margin has exceeded 51.8% in one fell swoop. Ranked sixth in the list of global IC design companies.

While the revenue prospects are promising, Marvell said last Thursday (October 27) that it will carry out large-scale layoffs in China.

"In China, our R&D investments will be focused on local customers and the Chinese market... In this restructuring, we Several business units and units announced adjustments to their global positioning strategies, leading to the elimination of jobs in China."

Marvell layoffs in China

Marvell did not specify the scale of the layoffs, but according to internal company documents obtained by Weibo, a Chinese online media outlet, the company's Shanghai-based engineering team of its information technology (IT) department, part of its infrastructure team and three other design departments will It was abolished. In addition, the two departments in Chengdu were also abolished, which means that most of the R&D teams will be abolished. The total number of Marvell employees in China once approached 1,000, and the international R&D center in Shanghai once had more than 800 R&D personnel, making it the third largest R&D center after the US headquarters and Israel.

Although the number of CEOs is unknown, the employees revealed that Marvell's specific compensation plan is N+3, that is, N years of in-service compensation for N months of salary, plus three months' salary. In this regard, Chinese netizens said that this is not a very generous compensation plan for layoffs.

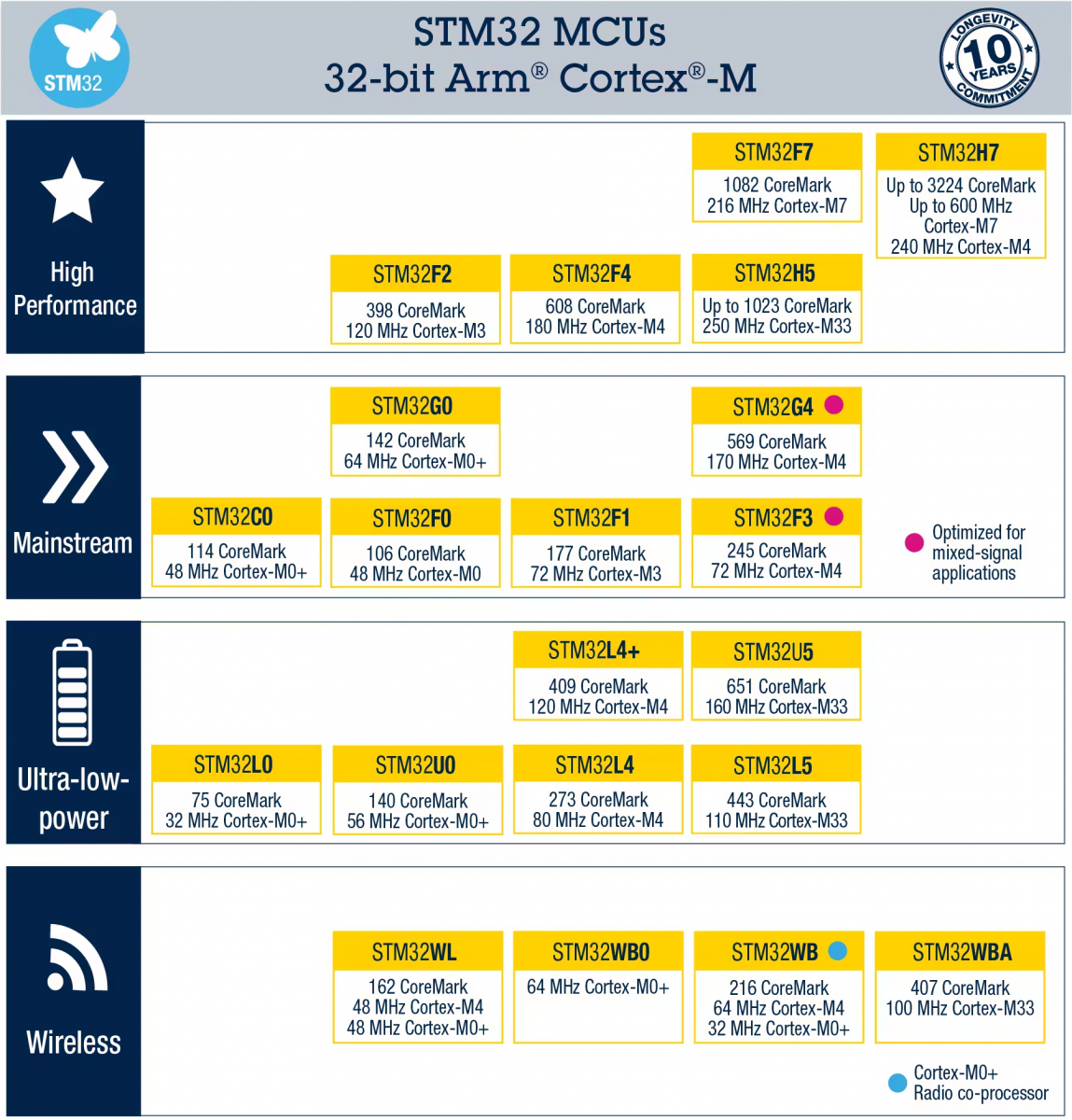

Marvell is the third major U.S. chipmaker to lay off workers in China this year as the U.S. and China compete for geopolitical and technological supremacy. Micron, a major American memory manufacturer, disbanded its Shanghai DRAM design department in January this year, with a total of more than 100 people, and Texas Instruments also abolished the R&D team of China's MCU department in May this year. R&D line moved to India.

China fears becoming a no-go zone for chip investment and talent flow

In response to this development momentum, three semiconductor industry experts interviewed by VOA said that the US sanctions against China's chip talents, which took effect on October 12, prohibit US citizens or permanent residents holding green cards from continuing to work for China's semiconductor factories. Directly grasping the soft underbelly of China's chip talent shortage will exacerbate the short version of China's local talent development in the future.

Abishur Prakash, co-founder of the Canadian Center for Innovating the Future and a geopolitical futurist, said that over the past month, the Biden administration has actively formed alliances with the world to contain China. The executive circle of global chip manufacturers gradually realized that the era of globalization with free global expansion and free flow of talents has come to an end, especially China has become a forbidden place for investment and talents.

Abishul Prakash said: "China will definitely be overwhelmed when faced with the realignment of human resources by American companies such as Marvell, because China has not yet reached the same level as the United States, the United Kingdom, or even Israel. We can cultivate the same level of chip talents.”

Abishul Prakash has published five books, including his new book The World Is Vertical: How Technology Is Remaking Globalization. He said that before foreign technology factories completely withdraw from China, they will adopt an "insulation" strategy to avoid being dragged down by the geopolitical hegemony between the United States and China. Therefore, there may be a domino effect in the future, and there will be more foreign chip manufacturers. It will follow in the footsteps of Marvell and start laying off more employees in China.

The domino effect of layoffs in foreign chip factories may continue to ferment

"The worst is yet to come, as China will be forced to adapt as a new global order emerges," Abishul Prakash said. "American companies are at the tipping point of transformation, and in the future they will Get out of China and stop aggressively marching into China.”

He said that global semiconductor manufacturers are facing three major problems. First, because technology and equipment are dependent on the United States, they are forced to choose sides and stand with the United States. Second, too many countries are vying to compete with China to become a regional chip city, including the European Union, Japan, South Korea, and even Saudi Arabia. This leads to the third problem: how can these foreign chip factories still operating in China maintain the profitability of their business in China?

"(They) will have a two-track strategy to achieve this (maintain China's profitability)," Abishul Prakash said. One track is made for Chinese customers and the other track is made for customers outside China. In fact, not only dual-track, the future may be multi-track, because there are too many countries (to make their own chips), not only China."

Lin Zongnan, a professor of electrical engineering at National Taiwan University in Taipei, also said that the expansion of U.S. sanctions on China will reduce the volume of U.S. business in China. He believes that this is the main reason behind the layoffs at Marvell.

He said that in order to develop semiconductors in China, in addition to capital and talents, it must also have production equipment. With the United States blocking China from multiple channels such as chips, technology, talents and equipment, China's domestic chips and talents have been blocked one by one.

It is difficult to develop local chip talents in China

Lin Zongnan said: "When the source of these high-level semiconductor talents is limited with the expansion of the Sino-US technology war, it (China) high-level talents (cultivation) is a big problem. Of course, the basic semiconductor production If there are talents, it can be trained locally. However, this is limited to relatively low-level mature manufacturing talents.”

"Economic Information Daily" once quoted Kou Xufeng, a professor at the School of Information, ShanghaiTech University, who pointed out that the most advanced chip manufacturing process has reached 3-5 nanometers, but Chinese university textbooks still stay at the micron level, which is a thousand times lower, "there is a large lag phenomenon. ”, and most professors have not kept up with the latest developments in the industry, so there is a big gap between theory and practice.

Lin Zongnan also said that in general, schools cannot update semiconductor equipment quickly, so they can only teach theory, and there is still a long way to go before students enter the factory and go online.

Lin Zongnan said: "Actually, it depends on the qualifications of the students, that is to say, the familiarity with the initial operation cannot be escaped in one or two years. If the technology needs to be more proficient, or even further research and development, it will take longer. ."

Although China has established a wide range of disciplines to cultivate chip talents, it still requires a process from the establishment of disciplines to the supply of talents. The Economic Information Daily quoted Zhao Zhanxiang, managing director of Shanghai-based Yunxiu Capital, as saying, "It takes ten years to train a mature chip engineer."

In addition, although the talent gap in China's semiconductor industry exceeds 200,000, the report also quoted Xu Wei, secretary-general of the Shanghai Integrated Circuit Industry Association, as saying that based on incentives, only about 30% of microelectronics graduates from some colleges and universities Entering the chip industry has exacerbated the tight supply of talents in the industry.

Li Fang, a senior partner at Beijing-based Blue Ocean Capital, believes that the Biden administration has blocked China's chip industry from two aspects: supply and talent.

Li Fang said: "It (Biden administration) has interrupted the supply channel of American companies to China, which is a direct impact. Indirectly, it is also very unfavorable for the cultivation of Chinese talents, because for so many years, Whether it is an American chip manufacturer or a Taiwanese chip manufacturer, building a factory in the mainland is actually cultivating a lot of talents for the mainland. Talent is also cut off.”

Although short-term pessimistic, Li Fang believes that there are many Chinese talents in the semiconductor industry. If China's political ecology can change the current closed situation, adhere to the keynote of opening to the outside world, and have peaceful exchanges with the West, it will help China to poach foreign talents or talents. back to China. He believes that in 20-30 years, based on China's patents and advantages in 5G and even 6G mobile chip standards, it may turn over in the future, or even break the US monopoly.

U.S.-China chip war

Li Fang also quoted the Beijing Daily as saying that the Chinese company Zhongke Xintong is expected to bypass the lithography machine of the Dutch business ASML next year and build the first photonic chip production line for mass production. He said: "If it is realized, the American There will be no control over the mainland chip industry...overtaking the U.S. will be ahead of schedule.”

For many years since the US-China chip war started, Prakash said that China has not yet taken a countermeasure. He worries that if China goes to extremes and announces that it will expel chip factories that comply with the U.S. ban from the Chinese market, then Silicon Valley and Wall Street executives may knock on the door of the White House and lobby Biden to loosen the ban on China.

Gu Wenjun, a Shanghai-based research analyst at Coremo, also posted on Weibo last week calling for China to "take measures to deal with U.S. sanctions," but was ridiculed by netizens. Some netizens left a message saying: "It's meaningless to write. What measures can be introduced? Can countermeasures be made?" Another netizen was not optimistic about China's ability, he wrote: "Bloggers overestimate the ability of little students (primary students) (ability)."

In this regard, Li Fang of Blue Ocean Capital also bluntly stated that China lacks countermeasures. Regarding someone's proposal to "restrict foreign companies from setting up factories in China" as a countermeasure, he believes that this is a "bad idea" that is counterproductive and hits the U.S. side!

Li Fang said: "In the field of chips, the mainland does not have much weight. It is different from the trade war. During the (US-China) trade war, the US imposed tariffs on us, which are the goods of the mainland in the past, and it will use tariffs. Card you, the mainland will also card American products, this is equivalent. But the United States has been in the chip for so many years, after all, it is very advanced in technology. Conversely, the mainland is lagging behind in this aspect, otherwise it will not be the United States As soon as it was shot, Huawei was stuck. So, I think the biggest problem is that we don’t have many countermeasures, and we don’t have the weight in our hands.”