According to the latest announcement of Hua Hong Semiconductor, the company, Hua Hong Grace, National Integrated Circuit Industry Fund II and Wuxi City Entity (Wuxi Xihong Guoxin Investment Co., Ltd.) entered into a joint venture agreement and a joint venture investment agreement on January 18, 2023.

According to the joint venture agreement, Hua Hong Semiconductor, Hua Hong Grace, China National Integrated Circuit Industry Fund II and Wuxi Municipal Entities conditionally agreed to establish a joint venture through the joint venture company and invest US$880 million, US$1.17 billion, US$1.17 billion, and 1.166 billion US dollars and 804 million US dollars.

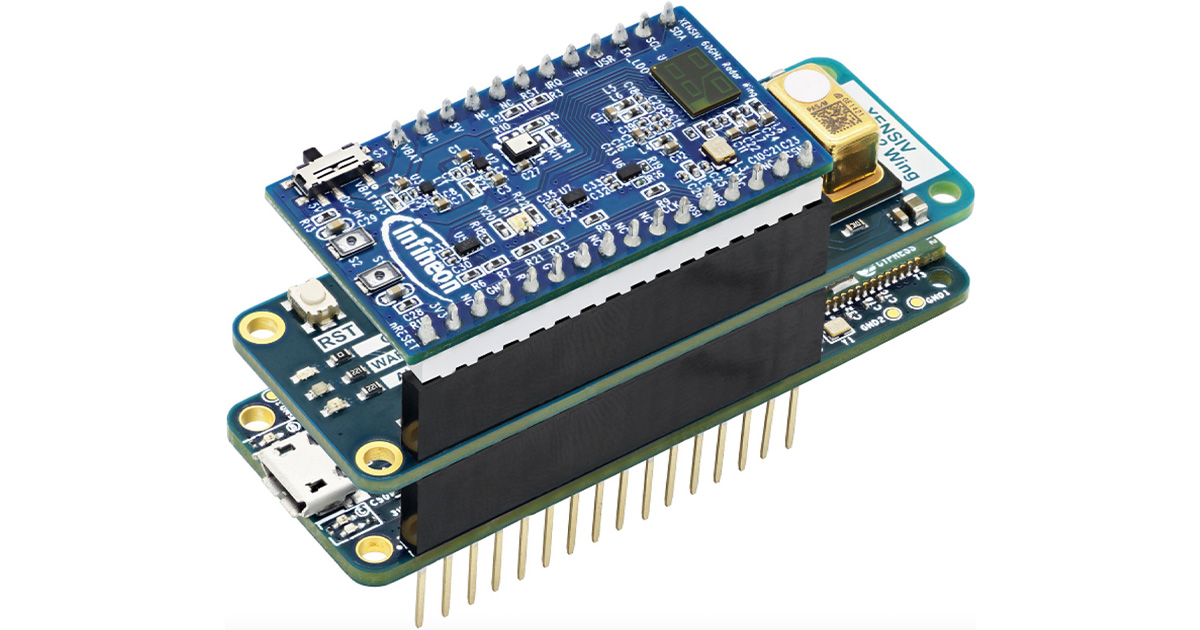

The joint venture will be engaged in the manufacture and sales of integrated circuits and 12-inch (300mm) wafers using 65/55nm to 40nm processes. The total investment in its business will reach US$6.7 billion (approximately RMB 45.456 billion), including US$4.02 billion contributed by the above-mentioned four parties, while the remaining investment of US$2.68 billion will be financed by debt financing.

It is reported that the above-mentioned joint venture company is Huahong Semiconductor Manufacturing (Wuxi) Co., Ltd., which was established on June 17, 2022. Its current registered capital is 100% held by Huahong Grace. However, according to the joint venture investment agreement entered into by Hua Hong Semiconductor, Hua Hong Grace, National Integrated Circuit Industry Fund II, Wuxi Municipal Entity and the joint venture company, the joint venture shareholders agreed to increase the registered capital of the joint venture company from 6.68 million yuan to 4.02 billion US dollars.

According to the announcement, after completing the relevant filings with the Chinese government, the joint venture company will be owned by Hua Hong Semiconductor, Hua Hong Grace, National Integrated Circuit Industry Fund II and Wuxi City Entity with 21.9%, 29.1%, 29% and 20% equity respectively. Hua Hong Semiconductor stated that the joint venture company will become a non-wholly owned subsidiary of the company after the completion of the transactions contemplated under the joint venture agreement and the joint venture investment agreement.

In addition, the joint venture company also entered into a land transfer agreement with Hua Hong Wuxi on January 18, 2023. According to this, Hua Hong Wuxi conditionally agreed to relocate the land at No. 28 and 30 Xinzhou Road and Xixing Road, Wuxi City, Jiangsu Province, China. Part of the land use rights of 249,049 square meters of land on No. 27 and No. 29 were transferred to the joint venture company at a total consideration of 170 million yuan. The site will be used to develop a fab to accommodate the joint venture's production lines for manufacturing integrated circuits and 12-inch wafers.

In recent years, despite weak global demand for consumer electronics, driven by 5G, new energy vehicles, and the Internet of Things, demand for semiconductors has remained strong. Even though Hua Hong Wuxi continues to expand its production capacity, it still cannot meet market growth. Hua Hong Semiconductor stated that it will continue to expand the production capacity of its production lines in 2023.

In fact, in addition to Hua Hong Semiconductor, another domestic wafer foundry manufacturer, SMIC, is also promoting production expansion, even after other wafer foundries have successively cut capital expenditure plans. Contrary to the trend, the capital expenditure in 2022 was raised to US$6.6 billion, an increase of up to 32%, and the prepayments for the equipment of the three new factories in Shenzhen, Beijing and Shanghai were planned in advance in 2023.

Zhao Haijun, CEO of SMIC, said that in the next 5 to 7 years, SMIC will have a total of about 340,000 12-inch new production line construction projects in SMIC Shenzhen, SMIC Beijing, and SMIC Oriental. The latest news is that the SMIC Lingang 12-inch wafer foundry production line project has been successfully capped on December 29, 2022, and the monthly production capacity of the plant will reach 100,000 wafers.

It is undeniable that at present, there is still a large gap between the supply and demand of China's domestic wafer production capacity. However, with the continuous expansion of Hua Hong Semiconductor, SMIC and other manufacturers, China's semiconductor localization process is expected to accelerate in the future. Securities institutions also believe that in the short term, local semiconductor companies have sufficient orders in hand, and their performance in 2022-2023 is expected to continue their rapid growth. In the medium and long term, it is optimistic that the domestic substitution process of semiconductors will accelerate.